delayed draw term loan accounting

Term loans are long-term financing solutions for fixed asset purchases and long-term projects. The panel will review the evolving uses of delayed draw term loans DDTLs in leveraged buyouts LBOs and other private equity transactions and critical points of negotiation including conditions precedent to making draws ticking fees loan term and fronting arrangements in.

Long Term Debt Types Benefits Disadvantages And More Money Management Advice Personal Finance Advice Finance Saving

Posted on 26 października 2020 by.

. For example they could range from 1 million to over 100 million. Borrowers need fixed assets with higher market value to pledge as collateral. Drawn DDTL costs mirror term loan spreads.

DDTLs were used in bespoke arrangements by borrowers who wanted to get incremental committed term loan capacity often for future acquisitions or expansions but wanted to delay the incurrence of the additional debt. Thus if and when a credit increase takes place all the terms are. They differ from revolving credits in that once repayments are made they cannot be re-borrowed.

Like revolvers delayed-draw loans carry fees on the unused portion of the facilities. Term loans come with consistency and stability that can help borrowers in financial forecasting. Fast forward to today.

These ticking fees start at 1. Delayed draw term loans are usually valued at very large amounts. 4 Borrowers can draw the loan down to Delayed Draw.

Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. And WACHOVIA BANK NATIONAL ASSOCIATION as Co-Syndication Agents MERRILL LYNCH CAPITAL. Delayed draw term loans may come in terms of say three or five years with interest-only periods such as six months to one year.

Delayed Draw Term Loan Availability Period means the period from and including the Closing Date and ending on the earliest of the following. Otherwise expressly provided herein all accounting terms used i If on any date the Borrower or any of its Subsidiaries Monsanto Co - on October 28 2016 company entered into a 1 billion delayed draw term loan agreement primarily to refinance maturing long-term debt For purposes This special type of term loan is only offered to individuals and firms that meet and maintain. 124 Delayed draw debt A reporting entity may enter into an agreement with a lender that allows the reporting entity to delay the funding of its debt provided it is drawn within a specified time period ie the reporting entity gets to choose the date that the debt funds within a.

The Delayed Draw Term Loan of each Term Loan Lender shall be payable in equal consecutive quarterly installments commencing with the first full fiscal quarter ending following the first borrowing of Delayed Draw Term Loans on the last day of each March June September and December each in an amount equal to one and one-quarter percent 125 of the aggregate. Delayed draw term loan Down payment Equity reserves FHA loans Good faith deposit HOA fees How much mortgage can I afford Installment credit Loan commitment Mortgage payments Mortgage service company Open-end loan Over-collateralization Pledged asset Revolving credit vs line of credit VA loans What is a mortgage What is a reverse mortgage. This CLE course will discuss the terms and structuring of delayed draw term loans.

Second the terms for the entire line of credit including all the incremental increases are negotiated at the onset. The purchase price for the acquisition was 900 million subject to adjustments outlined in the purchase agreement. Some key Limitations of a Term Loan.

1 the date of such Loan and 2 the amount of such Loan. Borrowers must adhere to the same specifics as for a revolver loan but with added language allowing a conversion to a term loan on a predetermined conversion date. 3413 Delayed draw term loan When a loan modification or exchange transaction involves the addition of a delayed draw loan commitment with the same lender we believe it would not be appropriate to include the unfunded commitment amount of delayed draw term loan in the 10 test since the commitment is not funded on the modification date.

This contrasts with commitment fees on revolvers of 50bp. All notices given by the Borrower under this Section 202 shall be irrevocable and shall be given not later than 1100 AM. A delayed draw term loan DDTL is a special feature in a term loan that lets a borrower withdraw predefined amounts of a total pre-approved loan amount.

A If with respect to any Lender the effective rate of interest contracted for under the Loan Documents including the stated rates of interest and fees contracted for hereunder and any other amounts contracted for under the Loan Documents which are deemed to be interest at any time exceeds the Maximum Rate then the outstanding principal amount of the loans made by such. Single Blog Title This is a single blog caption. Purchase specific assets for a.

Borrowers cannot reuse the facility without approval again. THIS DELAYED DRAW TERM LOAN AGREEMENT this Agreement is entered into as of May 5 2008 among PUBLIC SERVICE COMPANY OF NEW MEXICO a New Mexico corporation as Borrower the Lenders MORGAN STANLEY SENIOR FUNDING INC. Silgan funded the purchase price for the acquisition and related costs and expenses through term and revolving loan borrowings under its senior secured credit facility including the 900 million delayed draw term loan.

It intends to use the proceeds from this new facility to refinance its outstanding term loans under its existing 495 million facility and to fund potential share repurchases under its previously authorized stock repurchase program through a new delayed draw term loan of 175 million. Withdrawal periods could be every few months or every year. Delayed draw term loan accounting.

Spreads often increase if the term-out conversion is exercised. Prior to the COVID 19 pandemic a borrower could use a DDTL for a reason as undefined as an investment or general business purpose corresponding to the placement of cash on a companys balance. I the first day on which the aggregate amount of the Delayed Draw Term Loans advanced hereunder is equal to 25000000 ii the date that is the eighteen 18 month anniversary of the Closing Date and such earlier date on which the.

The Borrower shall give the Lender notice of any Loans under this Agreement at least three 3 Business Days before each Loan specifying. The withdrawal periodssuch as every. The late draw is ideal for sponsors whose investment work includes a series of complementary acquisitions which is almost all in the current climate.

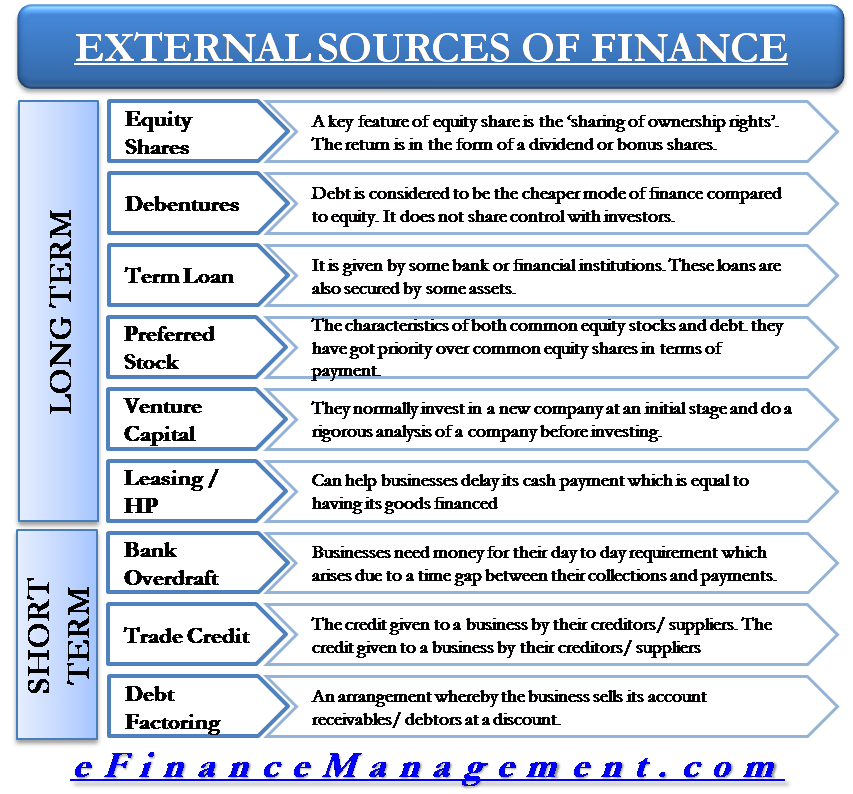

External Sources Of Finance Capital

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

What Is Short Term Financing Definition Sources Advantages And Disadvantages The Investors Book

Leveraged Buyout Model Advanced Lbo Test Training Excel Template

7 3 Classification Of Preferred Stock

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Financial Statements Definition Types Examples

Delayed Draw Term Loan Ddtl Overview Structure Benefits

Financing Fees Deferred Capitalized Amortized

Ryan Irvin Director Old Capital Linkedin

Understanding The Construction Draw Schedule Propertymetrics

Delayed Draw Term Loans Financial Edge

:max_bytes(150000):strip_icc()/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

Balance Sheet Definition Formula Examples

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Financial Statements Definition Types Examples

Financing Fees Deferred Capitalized Amortized

Expenditures Of Federal Awards Sefa Schedule 16 Office Of The Washington State Auditor